Bitcoin Under Pressure: Here’s What to Expect from the Largest Crypto

Trading is regulated under government regulations. Sounds safe and secure, right? The same has happened with the approval of the spot Bitcoin ETF. It is a Bitcoin exchange-traded fund, which is an investment pathway that tracks the price of Bitcoin. It stands out as it is not available on any cryptocurrency exchange and is traded on traditional regulated securities exchanges.

After the approval on January 10, 2024, the Bitcoin ETF has created a powerful impact in the crypto industry as the movement of the market is towards the bullish side, and at the end of January 2024, the price was estimated to have increased by 9%.

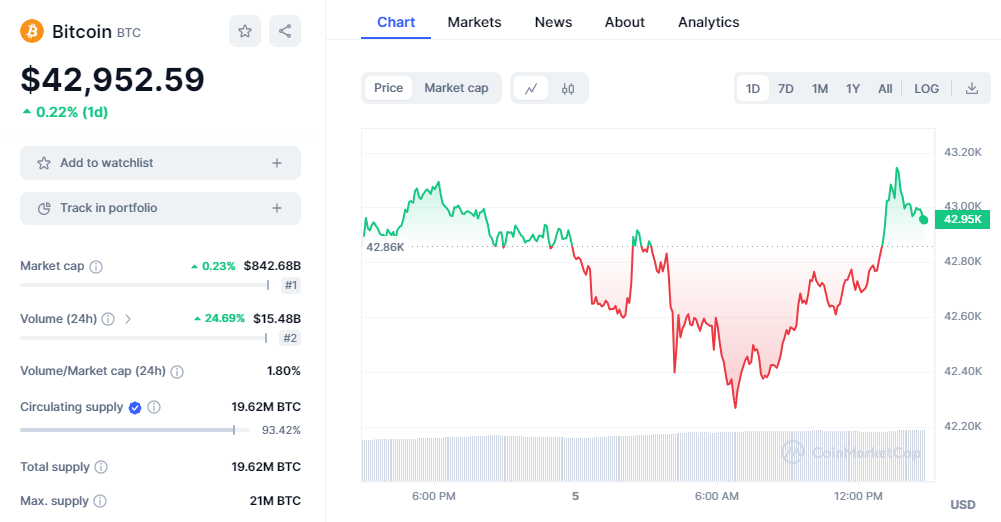

The Fear and Greed index is somewhere neutral at the time of writing and has a sense of a bullish market, and the price has increased by 3% in the past 24 hours. At the time the blog was written, the price of Bitcoin was somewhere around $43,299.49. Another major setback that will hold the market on the bullish side is Bitcoin halving, according to a few reports. This time, the reward for mining Bitcoin has been cut in half from before. The hype will impact the price, and the maximum circulation in the market will automatically help the price to remain high.

Spot Bitcoin ETF Approval: Post Reactions of Industry Experts

Spot Bitcoin ETF approval is a big game changer in the world of crypto. The crypto domain has always faced backlash from people and has been given names like scams, fraud, and fake, and is regarded as a bad name. Gradually people are understanding the concept of cryptocurrency and talking about developing countries like India somewhere it is expected that there will be 328.80m users by the year 2028. Crypto is being accepted by the people and here are some notable words mentioned by some of the industry experts:

Sergey Nazarov, co-founder of Chainlink, said: "The adoption of the Bitcoin ETF has shown that mainstream financial institutions have a significant impact on the course that cryptocurrency markets will take. This became clear when PayPal introduced the option to purchase specific cryptocurrencies and when certain banks began to provide cryptocurrency custody. Large, established financial institutions like Fidelity and BlackRock will flood the market after the [spot] Bitcoin ETF is approved, and they'll probably start playing a significant role in the cryptocurrency markets."

"The approval of a Bitcoin ETF adds more pressure on Congress to pass legislation that is appropriate for the digital asset ecosystem," stated Kristin Smith, CEO of the Blockchain Association. Demand from consumers is expected to rise rapidly, and those customers, investors, and business owners should have clear regulations that address many of the unanswered issues that the industry has been pressing our legislators and regulators to resolve."

Quarter 1: 2024

Crypto experts predict that in February 2024, the average Bitcoin rate will be $36,070, based on the value fluctuations of the cryptocurrency at the start of 2023. Expected prices are $28,967 at the minimum and $43,173 at the maximum. Experts in cryptocurrencies are prepared to share their predictions regarding the price of bitcoin in March 2024. In March, the lowest possible trading cost could be $38,313 and the highest possible cost could be $43,128. It is anticipated that the market value of Bitcoin will be approximately $40,720.78 on average.

Quarter 2: 2024

The average price of Bitcoin in the middle of 2023 will be $40,950.36. It's also possible that the value of Bitcoin will rise to $44,443.51 in May 2024. It is anticipated that in May 2024, the selling price will not fall below $37,457.21. Experts in the cryptocurrency space have examined the price of Bitcoin in 2023 and are prepared to offer their projected trading average of $39,179.81 for June 2024. The lowest and highest BTC rates may be $36,604.28 and $41,755.33.

Quarter 3: 2024

The price of Bitcoin will be trading at $33,766.88 on average amid the changing seasons of 2023. Crypto experts predict that the price of Bitcoin could range from $32,140.75 to $35,393 in September 2024. Experts in the market predict that the value of Bitcoin will stay below at least $33,512.35 in October 2024. This month, a maximum peak of $36,350.60 is anticipated. It is predicted that the standard value of trade will be approximately $34,931.48. Experts in cryptocurrencies have closely examined the fluctuation of BTC prices in 2023.

Factors that affect Bitcoin Price

Macroeconomic factors that affect Bitcoin prices are somewhere common in the traditional market. It includes stocks, bonds, and fiat currencies. Some factors are unique to the cryptocurrency market, which are:

Demand and supply

Traditional assets like commodities, securities, stocks, and cryptocurrencies are influenced by the interplay of demand and supply. Taking an example, the supply of Bitcoin is limited to 21 million tokens, and approximately 92% of Bitcoins have already been issued. It reflects the scarcity that helps Bitcoin grow in price over a long period.

Sentiment and social media

The sentiments are measured through the fear and greed index. It indicates whether the market is bearish or bullish. The bull market favours the majority of investors and traders because prices are rising constantly. A bear market is normally followed by capital outflows and discounted prices.

Node count and listings

It shows the number of computers in the blockchain network. It demonstrates the strength of the community. It has a higher number of nodes, which indicates a strong network. When a particular cryptocurrency has a fair price or has been overbought, Any user who wants to conclude can compare the node count with the market cap. There are many times when cryptocurrency prices are increased, followed by an increase in the node count.

Macroeconomic factors

Crypto is regulated as a hedge against macroeconomic factors. During an economic recession, individuals have the choice to limit their investment plans to any type of asset, which includes cryptocurrencies. Users can also liquidate their crypto investment if they are currently holding it.

Ending Note

Spot Bitcoin ETF approval is a big move in itself, and people considering cryptocurrency investment are heading in the right direction. It has been observed that altcoins have followed the price of bitcoin, and in the year 2024, the prediction is already reflecting on the bullish side. The year 2024 can be a boom for the crypto world, where exchanges are innovating and introducing new things that match the time and technology. The future of cryptocurrency is expected to be strong and will be a strong investment option.

Written by Suhani